This 2016 ISAAA Brief is an extension of the 20 Volumes of Annual Briefs (1996 to 2015) on global status of biotech/GM crops authored by Clive James,

Founder & Emeritus Chairman of ISAAA

Introduction

The International Service for the Acquisition of Agri-biotech Applications publishes the Annual Global Review of Biotech Crops Commercialization or ISAAA Briefs. ISAAA Brief 52 is the 21st of the series which documents the latest information on the subject, global database on the adoption and distribution of biotech crops in 2016 as well as the accumulative data since 1996 (the first year of commercialization), country situations, trends in approval of biotech crops, and future prospects of the technology in the biotech crop growing countries and the world. ISAAA Brief is one of the most cited references in the field of modern agri-biotechnology due to its credibility and accuracy. Since the adoption of biotech crops in 1996, ISAAA has remained the single most prominent source of this information.

The year 2016 was momentous since for the first time, Nobel Laureates released a statement in support of biotechnology and condemning critics in their critical stance against the technology and Golden Rice. The UN Food and Agriculture Organization, International Food and Policy Research Institute, the G20 countries and other like-minded bodies, guided by 2030 Agenda for Sustainable Agriculture have committed to eradicate hunger and malnutrition in 15 years or less. More importantly, the US National Academies of Sciences, Engineering, and Medicine published a review of 900 researches on biotech crops since 1996 and found that genetically modified crops and conventionally-bred crops have no difference in terms of probable risks to human health and the environment. Biotech crops have now had an unblemished record of safe use and consumption for over 20 years. Future generations can benefit more from wide choices of biotech crops with improved traits for high yield and nutrition as well as safe for food use and environment.

Highlights of the 2016 Adoption of Biotech Crops:

• Biotech crop planting in 2016 resumes high adoption at 185.1 million hectares worldwide.

A year after the second decade of commercialization of biotech/GM crops in 2016, 26 countries grew 185.1 million hectares of biotech crops – an increase of 5.4 million hectares or 3% from 179.7 million hectares in 2015. Except for the 2015 adoption, this is the 20th series of increases every single year; and notably 12 of the 20 years were double-digit growth rates.

• Biotech crops provide more diverse offerings to consumers in 2016

Biotech crops have expanded beyond the big four (corn, soybean, cotton, and canola) to give more choices for many of the world’s consumers. These biotech crops include sugar beet, papaya, squash, eggplant, potatoes that are already in the market, as well as apples which will be in the market in 2017. Potato is the fourth important staple crop in the world and eggplant is the number one vegetable consumed in Asia. Non-bruising and non-browning apples and potatoes can contribute to the reduction of food waste. Additionally, research done by public sector institutions include crops such as rice, banana, potato, wheat, chickpea, pigeon pea, mustard and sugarcane at advanced stages of evaluation, and are likely to provide even more diverse offerings to consumers, especially those in developing countries.

• New biotech crops and traits in the pipeline for the benefit of farmers and consumers

It is noteworthy that new biotech crops and traits are being field tested to cater to farmers and consumers. These include among others, staple crops such as beta-carotene enriched Golden Rice being tested in the Philippines and Bangladesh; bunchy top virus resistant biotech banana in Uganda; Fusarium wilt resistant biotech banana and biotech wheat with disease resistance, drought tolerance, altered oil content and grain composition being field tested in Australia; high yield and biomass wheat in the United Kingdom; late blight resistant potato varieties Desiree and Victoria in Uganda and late blight and nematode resistant potato variety Maris Piper with less bruising and less acrylamide potato in the EU; insect resistant chickpea and pigeon pea, and biotech mustard which are staple vegetables and oil source, respectively, in India; drought tolerant sugarcane in India and Indonesia; and omega-3 enriched camelina in the EU.

• Biotech crops increased ~110-fold from 1996, the fastest adopted crop technology in the world; accumulated hectarage at 2.1 billion hectares

Global hectarage of biotech crops has increased ~110-fold from 1.7 million hectares in 1996 to 185.1 million hectares in 2016 – this makes biotech crops the fastest adopted crop technology in recent times. An accumulated 2.1 billion hectares or 5.3 billion acres was achieved in 21 years (1996-2016) of biotech crop commercialization.

• 26 countries, 19 developing and 7 industrial countries grew biotech crops

The 185.1 million hectares of biotech crops were grown by 26 countries, of which 19 were developing and 7 industrial countries. Developing countries grew 54% (99.6 million hectares) of the global biotech crop area compared to 46% (85.5 million hectares) for industrial countries.

• Biotech soybean reached 50% of global biotech crop hectarage

The four major biotech crops: soybean, maize, cotton, and canola, in decreasing area, were the most adopted biotech crops by 26 countries. The area planted to biotech soybean was the highest at 91.4 million hectares, which is 50% of the global hectarage of 185.1 million hectares for all biotech crops. Although the soybean area only showed a marginal decrease of 1% from 2015 (92.7 million hectares), the area is still substantial at 91.4 million hectares. Based on the global crop hectarage for individual crops, 78% of soybean, 64% of cotton, 26% of maize and 24% of canola were biotech in 2016.

• Stacked traits occupied 41% of the global hectarage, second to herbicide tolerance at 47%

Herbicide tolerance deployed in soybean, canola, maize, alfalfa, and cotton, has consistently been the dominant trait at 47% of the global hectarage. A declining trend on herbicide tolerant crops planted was observed with the rise of stacked traits (combined insect resistance, herbicide tolerance, and other traits). The area planted to herbicide tolerant crops was 86.5 million hectares in 2016, occupying 47% of the global biotech hectarage of 185.1 million hectares. On the other hand, area planted to stacked traits increased by 29% in 2016 at 75.4 million hectares from 58.4 million hectares in 2015. Stacked traits occupied 41% of the global biotech crop hectarage of 185.1 million hectares.

• Of the top five countries growing 91% of biotech crops, three are developing countries (Brazil, Argentina, and India) and two are industrial (USA and Canada).

USA leads biotech crop planting in 2016 at 72.9 million hectares, followed by Brazil (49.1 million hectares), Argentina (23.8 million hectares), Canada (11.6 million hectares) and India (10.8 million hectares) (Table 1, Figure 1) for a total of 168.2 million hectares, 91% of the global hectarage.

USA continued to be the leader in the global commercialization of biotech crops since 1996. In 2016, 72.9 or ~73 million hectares were planted to major biotech crops: maize (35.05 million hectares), soybean (31.84 million hectares), cotton (3.70 million hectares), some areas of biotech crops: alfalfa (1.23 million hectares), canola (0.62 million hectares), and sugar beet (0.47 million hectares) and small areas of virus resistant papaya and squash (1,000 hectares each), and non-browning Innate™ potatoes (2,500 hectares). The USDA estimates indicate that the percentage adoption of the three principal biotech crops were at, or close to optimal adoption: soybean at 94% (same as 2015), maize 92% (same as 2015), and cotton 93% (lower by 1% in 2015) (USDA, NASS, 2016), for an average of 93%. The 2016 biotech crop area in the USA of ~73 million hectares is 39% of the global biotech area and 3% higher than the 2015 planting of 70.9 million hectares. The immediate increase of biotech/GM crop planted area in the USA in 2016 indicates that the 2015 slight decrease attributed to low commodity prices of maize and cotton was only temporary. Resumption of global prices and the active trade with countries for livestock feeds, food processing, and biofuel needs in 2016 put the US biotech crop adoption back on track with 3% increase from 2015.

Brazil retained its #2 world ranking after the US, with 49.1 million hectares of biotech crops planted, representing 27% of the global hectarage of 185.1 million hectares. Brazil’s total biotech crop hectarage of ~49.14 million hectares is an increase of 11%, from 2015 (44.2 million hectares), or 4.9 million hectares. This 4.9 million hectare increase was by far the highest increase in any country worldwide in 2016 making Brazil the engine of growth in biotech crops worldwide. Biotech crops planted include: ~32.7 million hectares biotech soybean; 15.7 million hectares of biotech maize (summer and winter maize); and ~0.8 million hectares of biotech cotton. The total planted area of these three crops in Brazil was estimated at 52.6 million hectares of which 49.14 million hectares or 93.4% was biotech. The adoption rate of 93.4% is a 2.7% increase in adoption compared to 2015 (90.7%). Similar to the U.S., adoption rates of the three major biotech crops are almost optimal at an average of 93.4%. IR/HT soybean Intacta™ has gained popularity among the farmers because of the savings in pesticide and the no-till technology, thus, the increased hectarages. The need for continuous and steady supply of maize for pork and livestock industry in the country may push farmers to plant more maize in 2017.

Argentina maintained its ranking as the third largest producer of biotech crops in the world in 2016, after the USA and Brazil, occupying 13% of global hectarage. The country planted 23.82 million hectares, 0.67 million hectares less than the 24.49 million hectares in 2015. Biotech crops in the country was comprised of 18.7 million hectares of biotech soybean, an all time high of 4.74 million hectares of biotech maize and a reduced cotton biotech area of 0.38 million hectares. The country had a slight decline in hectarages of biotech crops due largely to soybean and minimally with cotton due to global low cotton prices. The adverse weather condition was not conducive to wheat planting and affected the 2nd soybean planting after wheat. On the other hand, increased maize planting was mainly due to favorable weather conditions. With almost maximum adoption of biotech crops in Argentina of 97%, expansion of biotech crop commercialization can be achieved using new crops and traits.

Canada is fourth in world ranking of biotech crops, with an area of 11.55 million hectares, a 5% increase from 2015 of 10.95 million hectares, with an average adoption rate of 93%, similar to 2015. The four biotech crops grown in Canada in 2016 were canola (7.53 million hectares), soybean (2.08 million), maize (1.49 million), sugar beet (8,000 hectares with 100% adoption) and for the first time low lignin alfalfa (809 hectares). Total planting of these crops also increased by 5% from 11.74 million hectares (2015) to 12.38 million hectares. The country increased biotech crop planting following increases in total area of canola, soybean, and maize. Canola Council of Canada actively pursues its Strategic Plan of producing 26 MMT canola by 2025 through yield improvement technologies. Increase in soybean area is due to its profitability and high oilseed prices. For maize, increased gasoline and ethanol consumption due to lower gas prices provided incentive for maize planting.

India had a slight decrease (7%) in biotech cotton planting brought by a small reduction in the total cotton area (8%) in the 10 states of India. Adoption however increased from 95% to 96% indicative of acceptance by as much as 7.2 million farmers benefiting from the technology. Biosafety regulations in the country have been streamlined with revised guidelines on the monitoring of confined field trials of biotech crops. Biotech mustard expressing the barnase-barstar gene is under final review including public comments for environmental release in 2017. Mustard production and yields have remained stagnant for the past 20 years and the future introduction of the biotech mustard can potentially increase yield by as much as 25%, revive the mustard industry and be competitive with canola. Insect resistant chickpea and pigeon pea were approved for field trials by the government regulatory agency in 2016. India retained the title as the number one cotton-producing country in the world with cotton production surpassing 35 million bales despite the slowed down global cotton market.

• Ten countries in Latin America grew ~80 million hectares of biotech crops

Except for Chile and Costa Rica which continuously plant biotech crops for export, biotech crop countries in Latin America grew biotech crops for food, feed and processing. Brazil obtained the highest increase of 11% or 4.9 million hectares of biotech crops in 2016 and occupied 27% of the global biotech crop area. Intacta™ has gained popularity among farmers because of savings in pesticide and the no-till technology. Adoption rates of the three major biotech crops were almost optimum at an average of 93.4% in Brazil and Argentina. Total soybean and biotech plantings in Argentina and Bolivia were affected by severe drought. Moreover, in Paraguay, marginal decrease in soybean area was due to competition with maize planting to cater for the increasing demand of the expanding pork industry in the country. In Mexico, reduced soybean planting was due to conflicts resulting from negative propaganda for biotech crops. Biotech soybean and maize decreased in Uruguay due to lowered prices, higher production costs and positive policy developments for grain and soybean sector in Argentina. Lowered cotton prices also negatively affected Argentina, Mexico, and Colombia.

The possible expansion in the pork and livestock industry in Brazil may push farmers to plant more maize in 2017. New products waiting to be commercialized which are expected to impact the Brazilian economy are the biotech eucalyptus and virus resistant bean. In Argentina, the development of drought tolerant soybean which is now in testing stage will allow utilization of marginal areas affected by drought. Also, adoption of virus resistant potato will be beneficial to farmers in increasing yield and reduction of production cost. The area expansion in Paraguay and Colombia for total maize was due to the increasing expansion of the pork industry. This is likely to continue in the next few years with maize prices relatively higher due to demand from Brazil and Chile. Biotech maize adoption may also increase consequently. Countries affected by low global cotton prices may rebound back as soon as prices become stable, similar to maize which suffered low prices in the last two years. New biotech crops and traits that can withstand drought and other stress will be a welcome respite from the losses of the past years.

• Eight countries in Asia and the Pacific grew ~18.6 million hectares of biotech crops

Biotech crops planted in the 8 biotech crop countries of Asia and the Pacific ranged from fiber (cotton), feed (maize and canola) and food (maize and eggplant). Adoption of these biotech crops varied in 2016: India and China’s biotech cotton planting were extremely affected by low global cotton prices, while Pakistan and Myanmar maintained their biotech cotton area. The area planted to biotech maize in the Philippines and Vietnam increased due to high demand for livestock and poultry feeds, as well as favorable weather conditions. In Australia, favorable weather conditions after two years of drought permitted increased planting of biotech cotton and canola. In addition, farmers were provided BollgardIII/RR®Flex cotton for extreme insect pest protection with herbicide tolerance. Bangladesh increased its Bt eggplant planting to 700 hectares and more brinjal varieties with Bt gene are being field tested for future commercialization.

There are still huge potential biotech maize areas in China, Vietnam, Pakistan and the Philippines, as well as biotech cotton for Vietnam, Bangladesh and the Philippines. In China, food and manufacturing industry considered potato as the fourth staple with renewed interest on its research, development and production. The upcoming biotech potatoes which are non-bruising, low acrylamide, lowered reducing sugar and late blight resistant, as well as beta-carotene enriched Golden Rice will help address malnutrition and hunger in Asia and the Pacific.

• Four countries in the European Union continued to plant biotech maize at more than 136,000 hectares

Four countries in the EU (28) continued to plant biotech maize (IR maize event MON 810). In 2016, they were Spain with 129,081 hectares, Portugal (7,069 hectares), Slovakia (138 hectares) and Czechia (75 hectares) for a total of 136,363 hectares. Thus, a significant difference of 19,493 hectares or 17% increase from 116,870 in 2015 was achieved. The more than 95% of the total biotech maize in the EU was planted in Spain. In Spain and Slovakia, increases in biotech maize planting were due to favorable farmers’ decision to plant insect resistant maize because of the devastating European corn borer infestation. In Portugal, in addition to the low market price of maize, drought spell affected the highest maize producing state, Alentejo. This resulted to a decline in total maize area and consequently the biotech maize area. In Czechia however, the continuing decline in biotech crop planting was due to the inconvenience of stringent reporting requirements for IR maize resulting in less incentive for farmers and all stakeholders seeking to capture the benefits offered by IR maize. This matter also affected Romania, which, similar to the other countries have opted to grow GM crops after the EU directive was issued in 2015. Thus, for 2016, there was no biotech maize planting in Romania.

Possible expansion of biotech crops in these countries includes the approval of new crops and traits that will address the recurring problem of corn borer infestation such as the various IR/HT maize technologies. In addition, drought tolerant maize available in the US and a product similar to the biotech maize with drought and insect resistant trait of the WEMA Project will benefit farmers in Portugal.

• South Africa and Sudan had increased planting of biotech crops

By 2016, at least four countries had in the past placed a GM crop in the market – Burkina Faso, Egypt, South Africa, and Sudan. However, due to a temporary setback in Burkina Faso and Egypt, only South Africa and Sudan planted biotech crops at 2.8 million hectares. South Africa is one of the top ten countries planting more than 1 million hectares in 2016 and continued to lead the adoption of biotech crops in the African continent. Biotech maize, soybean and cotton area increased to 2.66 million hectares in 2016, a 16% increase from the 2.29 million hectares in 2015.

A new wave of acceptance is emerging in the continent. Three countries: Kenya, Malawi and Nigeria transitioned from research to granting environmental release approvals, while six others – Burkina Faso, Ethiopia, Ghana, Nigeria, Swaziland and Uganda made significant progress in moving towards completion of multi-location trials in readiness for considering commercial approval. Three of these crops – banana, cowpea and sorghum are new and primarily for food security. It is noteworthy that under the Water Efficient Maize for Africa (WEMA), Tanzania planted its first ever confined field trial of drought tolerant maize while Mozambique granted its first ever approval for a confined field trial of a stacked trait, an insect reistant and drought tolerant maize.

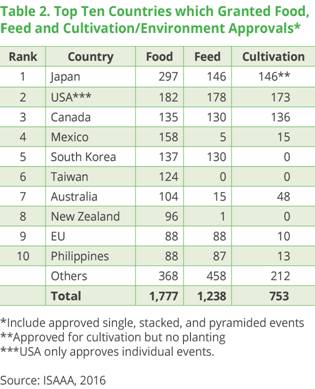

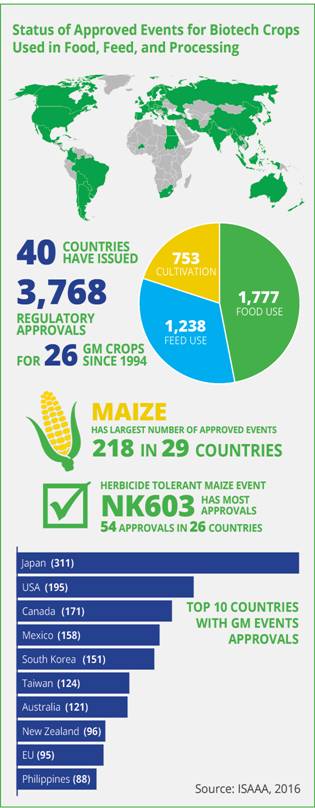

Status of approved events for biotech crops used in food, feed, and processing

Biotech crops were planted in small scale as early as 1994 and large scale plantings were recorded in 1996. From 1994 to 2016, a total of 40 countries (39 + EU – 28) have issued regulatory approvals to genetically modified crops for consumption either as food and/or feed as well as for environmental release. From these countries, 3,768 approvals have been issued by regulatory authorities across 26 GM crops (not including those for carnation, rose and petunia) and 392 GM events. Of these approvals, 1,777 are for food use (direct use or for processing), 1,238 are for feed use (direct use or for processing) and 753 are for environmental release or cultivation (Table 2). Maize still has the most number of approved events (218 in 29 countries), followed by cotton (58 events in 22 countries), potato (47 events in 11 countries), canola (38 events in 14 countries), and soybean (35 events in 28 countries).

The herbicide tolerant maize event NK603 (54 approvals in 26 countries + EU-28) still has the most number of approvals. It is followed by herbicide tolerant soybean GTS 40-3-2 (53 approvals in 27 countries + EU-28), insect resistant maize MON810 (52 approvals in 26 countries + EU-28), insect resistant maize Bt11 (50 approvals in 24 countries + EU-28), insect resistant maize TC1507 (50 approvals in 24 countries + EU-28), herbicide tolerant maize GA21 (49 approvals in 23 countries + EU-28), insect resistant maize MON89034 (48 approvals in 24 countries + EU-28), herbicide tolerant soybean A2704-12 (42 approvals in 23 countries + EU-28), insect resistant maize MON88017 (41 approvals in 22 countries + EU-28), insect resistant cotton MON531 (41 approval in 21 countries + EU-28), herbicide tolerant maize T25 (40 approvals in 20 countries + EU-28) and insect resistant maize MIR162 (40 approvals in 21 countries + EU-28).

Global value of the biotech seed market alone was US$15.8 billion in 2016.

In 2016, the global market value of biotech crops, estimated by Cropnosis was US$15.8 billion (up by 3% from US$15.3 billion in 2015); this represents 22% of the US$73.5 billion global crop protection market in 2016, and 35% of the US$45 billion global commercial seed market. The estimated global farm-gate revenues of the harvested commercial “end product” (the biotech grain and other harvested products) are more than ten times greater than the value of the biotech seed alone.

Contribution of biotech crops to food security, sustainability and climate change

Biotech crops contributed to food security, sustainability and climate change by:

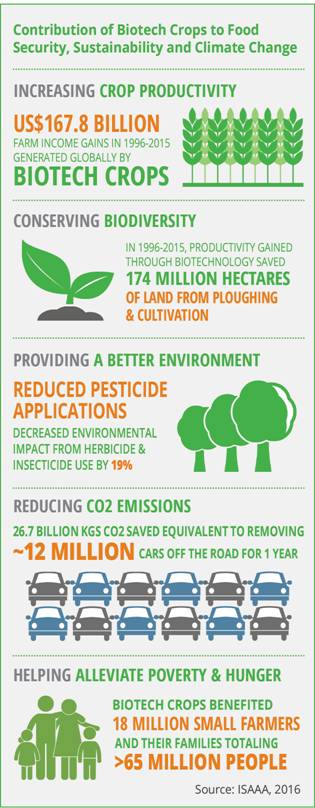

• increasing crop productivity 574 million tons valued at US$167.8 billion in 1996-2015; and 75 million tons valued at US$15.4 billion in 2015 alone;

• conserving biodiversity in 1996 to 2015 by saving 174 million hectares, and 19.4 million hectares in 2015 alone;

• providing a better environment

– by saving 620 million kg. active ingredient (a. i.) of pesticides in 1996-2015, and by 37.4 million kg in 2015 alone;

– by reducing pesticide applications, saving 8.1% in 1996-2015, and by 6.1% in 2015 alone;

– by reducing EIQ (Environmental Impact Quotient) by 19% in 1996-2015, and by 18.4% in 2015 alone

• reducing CO2 emissions in 2015 by 26.7 billion kg, equivalent to taking 11.9 million cars off the road for one year; and

• helped alleviate poverty by helping 18 million small farmers, and their families totaling >65 million people, who are some of the poorest people in the world (Brookes and Barfoot, 2017, Forthcoming).

Thus, biotech crops can contribute to a “sustainable intensification” strategy favored by many science academies worldwide, which allows productivity/production to be increased only on the current 1.5 billion hectares of global crop land, thereby saving forests and biodiversity. Biotech crops are essential but are not a panacea and adherence to good farming practices, such as rotations and resistance management, are a must for biotech crops as they are for conventional crops.

Regulatory barriers holding back biotechnology’s benefits

Onerous regulation for transgenic crops remains the principal constraint to adoption, which is particularly important for many developing countries, denied the opportunity of using biotech crops to address food, feed, and fiber security. Opponents of GM crops are against science-based regulation and are demanding onerous regulation that is denying poor farmers in the developing countries, as well as Europe’s access to the technologies. All these challenges are faced by farmers and technology developers despite the overwhelming evidence in support of the safe use of these technologies. By using these technologies, small poor farmers will be able to survive and contribute to the doubling of food production to meet the needs of a growing population which will reach over 11 billion in 2100.

Future of Biotech Crops: A Game Changer

As biotech crops enter the third decade of planting/commercialization, game changing innovations are projected to revolutionize development of new biotech crops and traits. Firstly, the increasing adoption and appreciation by farmers of stacked traits; secondly, the advent of biotech crops and traits that not only cater to farmers agricultural needs but more so the preference and nutritional needs of consumers; and thirdly, the heightened utilization of innovative tools of gene discovery and their subsequent use in crop improvement and varietal development.

The first generation of biotech crops targeted input traits of herbicide tolerance, insect resistance and virus resistance where farmers and food producers benefited economic gains of 574 million tons valued at US$167.8 billion in 1996-2015. These benefits also provided accessible food and nutrition for the 7.4 billion global population. The second generation biotech crops include stacks of these traits, as well as drought tolerance – one of the problems related to climate change. Adoption of IR/HT soybean (Intacta™) and corn rootworm stacks for maize have been phenomenal with an economic benefit of US$2.4 billion in 2013-2015 and US$12.6 billion in 2003 to 2015, respectively (Brookes and Barfoot, 2017 Forthcoming).

Output traits for improved quality and composition were the traits of the third generation biotech crops geared towards consumer preference and nutrition. These include the various health-improving products of soybean for humans and animals (omega-3 fatty acids, high oleic acid, low phytate, and high stearic acid), modified starch/sugar (potato), low-lignin (alfalfa), non-browning potatoes which are already available; non-browning apples projected to be available in the US market in 2017; as well as beta-carotene and ferritin in major staple crops which are already in the advanced stages of development. It is noteworthy that Innate™ potato series have been commercialized successfully in the USA, with 2,500 hectares of potatoes and 70,000 non-browning apple trees (~81 hectares). Acceptance of these two biotech crops can contribute in the reduction of food waste due to browning and easy spoilage of products.

Innovative molecular biology tools are continuously being developed and tapped to discover new genes that would make food available, accessible and nutritious. Biotech products which are already in field testing and maybe released in the next few years reflect the increasing trends for various inputs and output traits for farmers and consumers. Staple crops such as rice, banana, potato, wheat, ryegrass, Indian mustard, chickpea, pigeon pea and sugarcane, among others were improved to contain new traits for insect and disease resistance, drought and stress tolerance, improved nutritional content, and yield and biomass among others.

The encouraging outlook is that technology, in conjunction with conducive policies can double food production. However, the doubling of food production cannot be realized by society unless it ensures that regulation of GM crops is science/evidence-based, fit for purpose, and to the extent possible harmonized globally. Failure by global society to ensure timely and appropriate regulation on food production will have dire consequences. On the one hand, the world will suffer because of inadequate food supplies, while on the other hand, the power of science and technology to produce a safe, adequate and assured supply of food for all mankind will be rejected because of the dominant ideological voices of the opponents of the new biotechnologies.

Conclusion

In 2016, global hectarage of biotech crops increased from 179.7 million hectares to 185.1 million hectares, a 3% increase equivalent to 5.4 million hectares. Predictions made by James, C. (2015) that the slight decline in biotech crop area in 2015 due to the low global commodity price would immediately reverse once crop prices revert to higher levels were realized – this is contrary to propaganda by critics that biotech crops are failing the farmers. Fluctuations in biotech crop hectarage of this order (both increases and decreases) are influenced by several factors. In 2016, these factors were: acceptance and commercialization of new products in the USA, Brazil and Australia; increasing demand for pork and livestock feeds in Brazil; needs for livestock and poultry feeds in Vietnam; favorable weather conditions and improved market price for maize in the Philippines and Honduras; need to address corn borer infestation in Spain and Slovakia; government’s strategic plan to harness biotechnology and improve economy in Canada; the lifting of the GM ban in West Australia; and consumers demand for more of the clean and healthy brinjal in Bangladesh. Biotech crop hectarage in Myanmar and Pakistan did not change, as in some smaller countries.

A few countries had decreased biotech crop planting due to global low cotton prices such as in Argentina, Uruguay and Mexico, and high cotton reserve stocks particularly in China and low cotton price in India; low profitability in soybean and competition with maize in Paraguay and Uruguay; environmental stress (drought/submergence) in soybean plantings in South Africa, Argentina and Bolivia; negative biotech perception in China as well as onerous reporting requirements in Czech Republic. Lastly, onerous requirements made farmers in Romania stop planting biotech crops in 2016.

Finally, biotech crops are here to stay and will continue benefiting the burgeoning population with new biotech crops and traits to cater to the needs of farmers and consumers alike. However, even after 21 years of successful commercialization of biotech crops, some challenges remain including:

• First, the regulatory barriers that limit scientific innovation and restricts technology development that would have benefited farmers and consumers.

• Second, the growing trade disruptions brought by asynchronous approvals and thresholds on low level presence in GM crop trading countries. Following the Cartagena Protocol on Biosafety, countries allow entry of only approved biotech events, and a threshold for unapproved events. Some countries have stringent or long process of approvals that cause problems if imported products contain unapproved events, especially in a stacked event. The report and analysis by the Council for Agricultural Science and Technology (CAST, 2016) on the Impact of asynchronous approvals for biotech crops on agricultural sustainability, trade and innovation indicate that there are large volumes of trade worth billions of dollars at risk. A thorough research is needed to evaluate the global cost of asynchronous approvals and low level presence (LLP), the impacts of asynchrony on innovation and crop improvements, and the decision-making process of biotech developers, in both the public and private sectors. Timely research and possibly, an international dialogue on trade would inform policymaking and improve the design of policy instruments.

• Third, the need for continuous dialogue among all stakeholders for the expeditious understanding and appreciation of biotechnology, emphasizing benefits and safety. Innovative communication modalities using social media and other forms of venues should be tapped and utilized effectively and immediately.

Overcoming these challenges is a daunting task that requires a cooperative partnership among the North and the South, East and West, and public and private sector. Only through partnerships can we be assured that nutritious and sufficient food will be readily available on the table, stable supply of feed for our poultry and livestock, and accessible clothing and shelter for everyone.

Dr. Clive James, founder and emeritus chair of ISAAA, has painstakingly authored the 20 annual reports ensuring the ISAAA Brief to be the most credible source of information on biotech crops in the last two decades. He has been a great advocate of the technology and biotech products following the footsteps of his great mentor and colleague the late Nobel Peace Laureate Norman Borlaug, who was also the founding patron of ISAAA. The 2016 ISAAA Brief continues this tradition of providing an up-to-date report on biotech products through information gathered from an expansive global network of biotechnology information centers and other partners.